The new North Shore CRE Servicing software module is the final piece of the end-to-end North Shore solution to be developed, as the company left the best for last. The comprehensiveness and usability of the servicing software module are the culmination of many years of experience developing, implementing, and using servicing and accounting systems by the company principals, and the support and development staff.

CRE & Construction Finance Servicing Software

With a sole focus on the CRE and construction finance since the inception of the company, NSS has brought an understanding of the industry’s needs like no other vendor. After years of research and planning, it has designed a system that provides what is essential to successfully implement a new platform or convert from an existing one, handle all loan and investor types, comply with regulators & CREFC, and provide an excellent customer and partner experience.

This servicing software module can be used stand-alone, in conjunction with your front-end systems, or as one component within a single, integrated end-to-end North Shore platform.

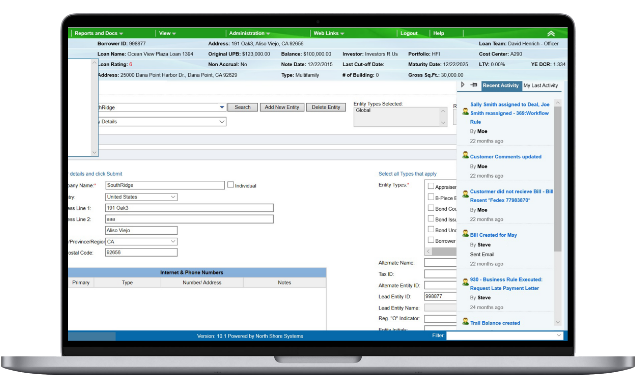

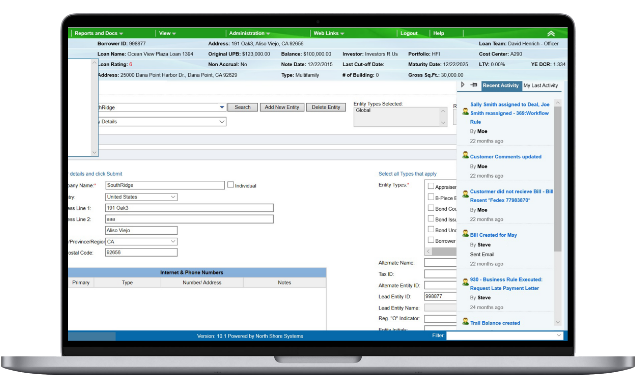

Easy Navigation:

Stay organized your way. Search by Recent Activity, Deal Entity or any number of ways that suit your workflow preferences.

Flexible Billing/Payment Options:

The system supports all loan types and servicing options.

Years of Experience

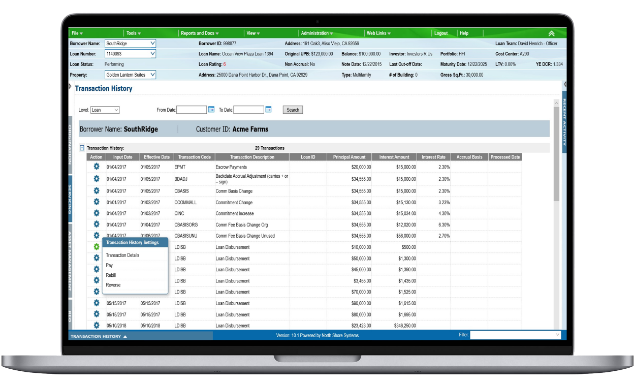

Transaction History:

An intuitive interface for searching and viewing history at summarized and detailed levels.

Features & Functions

User-Defined Business Rules & Edits:

- Credit Policy

- Loan Performance

- Compliance

- Workflow

- Pricing

- Portfolio stressing/ sensitivity

Escrows for Taxes & Insurance with:

- No limit on number for each

- Individual receipt & disbursement schedules

- Reserves

- Workflow

- Optional Interest on each

Collateral can be at all levels:

- Commitment

- Loan

- Part

- Investor

- Shadow

Unlimited numbers of:

- Hierarchical relationships

- Commitment and Limit Controls

- Pricing Tiers

- Default and penalty options

- Billing and collection options

- Shadow accruals

Unlimited schedules for:

- Interest

- Fees

- Expenses

- Shadow Accruals

- Collateral

- Escrows and more

User-Defined Credit Products

Benefits

reduction in servicing costs

improvement in system reliability & availability

improvement in real-time data availability

reduction in manual billing adjustments

reduction in phone/fax/ email usage

reduction in nightly batch cycle time

reduction in loan boarding time