North Shore’s industry-leading loan origination software module tracks every aspect of a new loan, from lead to closing. It can be implemented as a stand-alone LOS, with lead information coming in from a CRM tool on the front-end, and the loan being passed on to another system/entity on the back-end after closing, or it can be implemented along with the North Shore Asset & Portfolio Management module, in which case the client realizes the added value of front-end and back-end being the same system.

More Than Just Loan Origination Software

In addition to handling all usual loan origination software processes it also covers all types of commercial and CRE credit and debt investments, the module utilizes the underlying BRE, Doc Prep, API’s, and customer-facing Portal to capture ALL data related to a deal and to provide ALL of the output required for ALL internal and external entities involved.

Please reach out via our contact form for more information on the North Shore Loan Origination System.

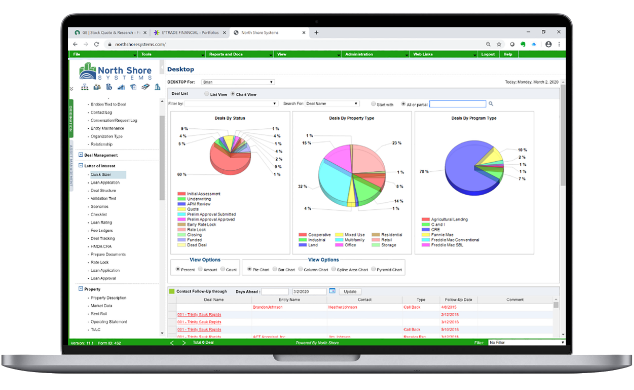

Pipeline/Workflow:

Users of different roles can monitor their in-baskets and workloads, in list view or graphically

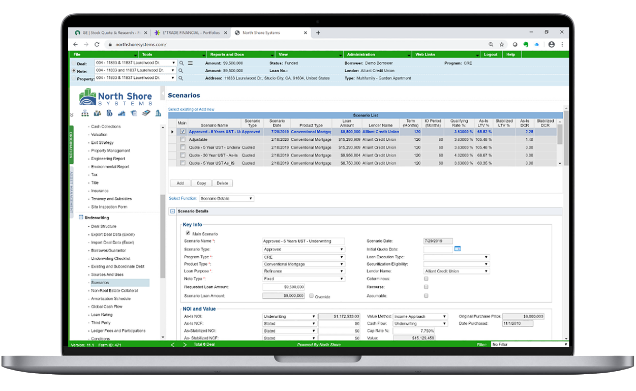

Underwriting Scenarios:

Track all quoting/sizing activity and compare different deal executions side by side.

Industry Leading

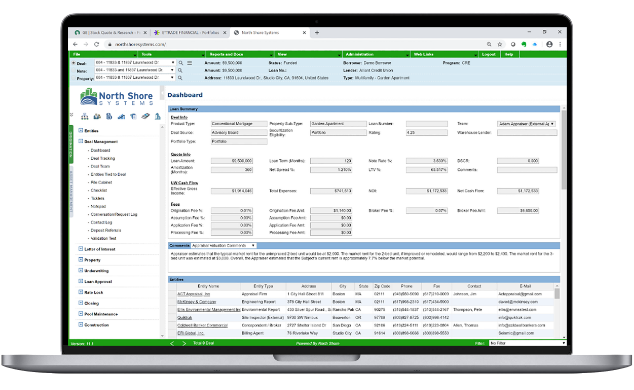

Deal Dashboard:

Consolidated view of everything previously done or outstanding for a deal at any point in time.

Features & Functions

- CRM Integration

- Customer/Broker Portal

- Workflow Automation & Pipeline Tracking

- Multiple Notes/ Properties/ Borrowers Per Deal

- Online Application

- Document Generation

- Excel integration and/or Integrated Underwriting

- Online Underwriting

- Automated Third-Party Feeds

- Loan and Borrower Rating

- Management Reporting

- Quote Tracking

- Contact Log

- Procedure & Document Checklists

- Committee Presentation

- Complete Closing & Accounting Functions

- Underwriting & Credit Policy Business Rules

Benefits

less time reconciling discrepancies between documents

reduction in time from in-closing to closed

increase in loan quality (& closed)

reduction in spreadsheet usage

decrease in loan cycle times